Why invest?

Whitbread is the UK’s largest hospitality business, employing c.34,000 people and a long-time constituent of the FTSE100. We are the number one hotel operator in the UK with a leading value F&B offering and are rapidly expanding our Premier Inn brand in Germany. The following are key elements of our investment case:

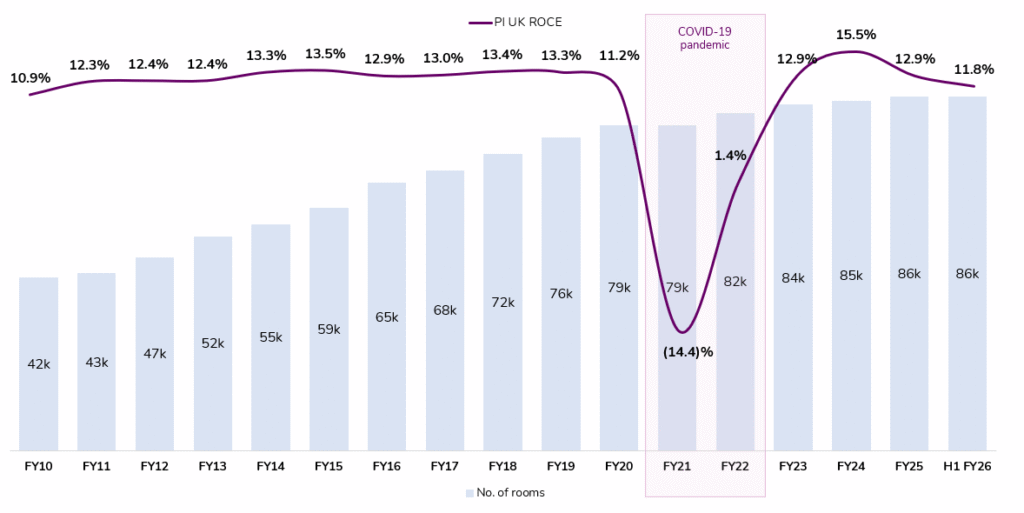

Strong track record of attractive returns for shareholders

Our strong balance sheet and vertically integrated business model differentiate us from many other hotel groups. However, in conjunction with the careful execution of our business strategy, they have delivered strong growth both in the UK and now Germany, whilst also continuing to deliver a consistent and superior customer experience. The result has been an impressive track record of consistent returns for our shareholders, outside the pandemic, and additional benefits for our other key stakeholders.

Disciplined capital allocation delivers long-term sustainable returns

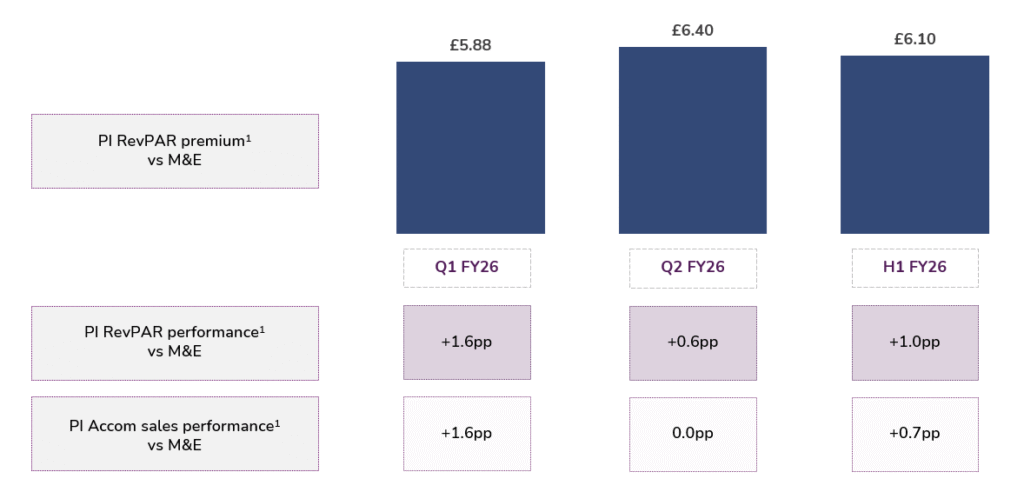

Market leader in the UK

With c.850 hotels, you are never far from one of our establishments. We consistently outperform the rest of the Midscale and Economy hotel sector in the UK:

Premier Inn UK performance vs the M&E market

1: STR data, standard basis, Premier Inn accommodation sales and absolute RevPAR 28 February 2025 to 28 August 2025, UK M&E market excludes Premier Inn

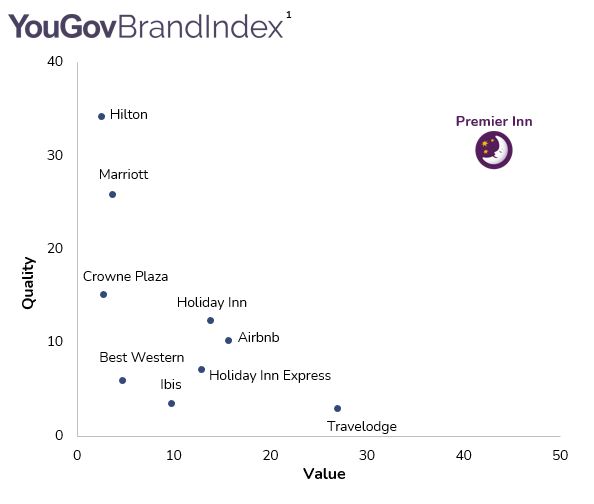

Operationally, we control all key areas of the customer journey, helping us to achieve excellent guest scores a reputation for quality and value

1: YouGov BrandIndex Quality & Value scores as at 28 August 2025 based on a nationally representative 52-week moving average

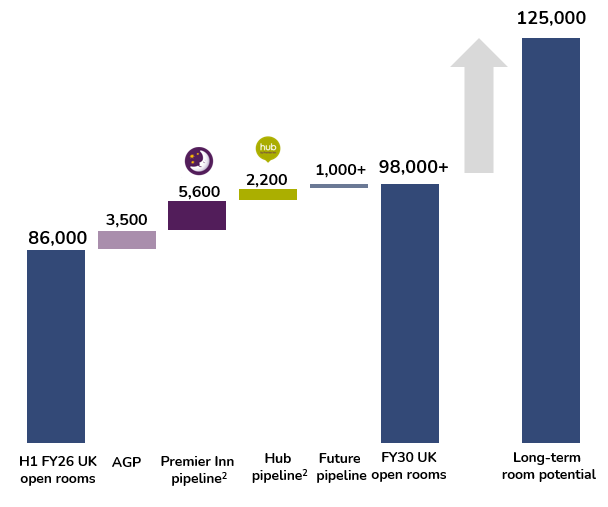

We have significant growth potential in the UK and Ireland

UK&I Growth | Long-term room potential of 125,000 rooms

Long-term room potential

- UK target equivalent to 17% market share

- Postcode level analysis in 1,744 catchments, mapping existing supply and opportunity

- Opportunity across all regions particularly in London and South East

Pathway to 125,000 rooms

- Extensions of high occupancy freehold hotels

- Organic pipeline growth and single site acquisitions

- Roll-out of hub concept in London

- Estate optimisation

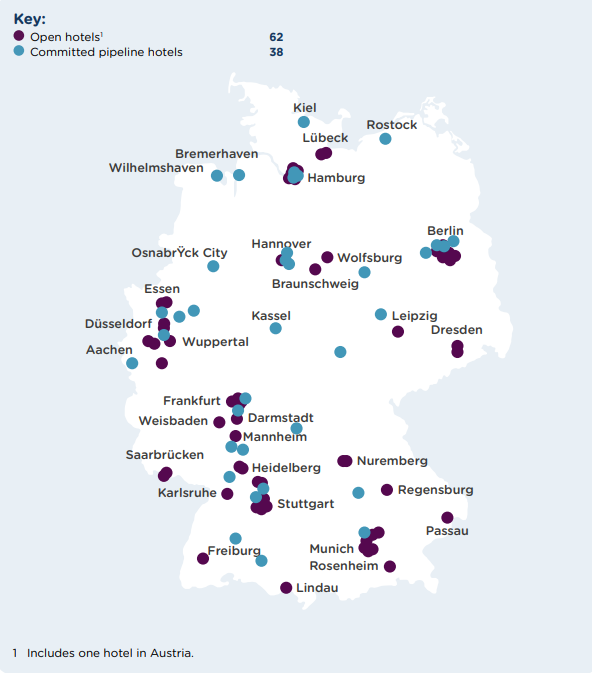

We have a growing presence in Germany

Fastest Growing Hotel Brand In Germany

- >11,000 open rooms

- c.9,000 rooms in the committed pipeline

- Estate growth through organic pipeline and M&A

- Map shows number of hotels as at 27 February 2025

In Germany, since opening our first hotel in 2016, our network has grown rapidly and as at 28 August 2025 we have 11,000 open hotel rooms and c.9,000 rooms in the committed pipeline. Focusing on prime locations across the country, we are working hard to grow our brand presence and build our customer base.

We have a strong balance sheet with significant asset backing

We have a substantial freehold property portfolio that represents a real source of competitive advantage. We are rated BBB (Fitch Ratings 23 May 2025) and as at 28 August 2025 had net debt of £563m.

Our strategic priorities

The execution of our three strategic pillars is delivering strong financial results. This performance, together with our vertically-integrated business model, strong fundamentals and appropriate capital structure mean we now have a platform for continued long-term growth, both in our core UK market as well as in Germany.

Our Force for Good program underpins the decisions we make, ensuring we operate responsibly and sustainably in everything we do. We are rated AA by MSCI and medium-risk by Sustainalytics and have also progressed our validation process and our carbon targets have been validated by the Science Based Targets Initiative.

Read about our business model in the about us sectionGrow and innovate in the core UK markets

- Ownership and operating model is a competitive advantage

- Vertically integrated operating model is a competitive advantage

- Number one brand in the UK and a winning customer proposition

- Growth through existing pipeline, single site acquisition and optimisation

Market

share

gainsFOCUS ON OUR STRENGTHS TO GROW IN GERMANY

- Replicate our UK success in Germany

- Ambition to be the market leader

- Significant headroom to grow – organic and M&A

GROWTH

Build the capability to support long-term growth

- Freehold value and ongoing efficiency programme

- Ongoing investment in our teams and technology

- Balance sheet flexibility and ability to invest

PROFITABLE

GROWTH AT

ATTRACTIVE

ROCE

Our strengths & opportunities

A structurally advantageous market combined with our strong and agile business model makes us well-placed to capitalise on the recovery opportunity and reinforce our market leading position.

- UK

- Germany

Enhanced structural opportunities

Market supply contraction accelerating PI market share gains and growth opportunity

Accelerated Decline In Independent Supply

‘000 rooms

- Both UK and German markets are highly fragmented with a high percentage of independent hotel players

- Both markets are characterised by long-term migration from independents to budget branded hotels, driven by demand weakness and structural cost pressures and operational advantages

- The pandemic increased the rate of independent exits in the UK hotel sector, and with a continued favourable supply environment, we do not expect UK supply to reach pre-pandemic levels until at least 2027

Budget model is structurally advantaged

Budget hotel sector is higher growth and outperforms in downturns

Total Supply Contracted In Aftermath Of Pandemic

Total Hotel Supply ‘0001

- The UK budget branded sector has grown faster than the rest of the hotel market

- The German hotel market is highly fragmented with the largest operator only having c2% market share. Our aim is to become the clear no 1. hotel brand in Germany.

Broad customer reach

Flexible model caters to a wide range of customer types

- Premier Inn’s customer base is driven by domestic travellers seeking short stays (typically 1 – 2 nights) for both business and leisure

- This broad reach not only covers a wide range of customers and markets, but also makes us more resilient as we’re not reliant on one particular area of the market

- The German market is larger than the UK and also has higher levels of domestic travel for both business and leisure, making this a highly attractive market in which to replicate our successful UK business model

Strong hotel brand

Strong hotel brand in the UK

- We have standout customer brand scores in the UK hotel market and expect customers to rely more on their most trusted brands as they seek to travel again

- As our presence grows in Germany, we are working hard to replicate the success we have in the UK and grow the Premier Inn brand

Best-in-class operations

Competitive advantage driving a winning customer proposition

Brand strength

- UK’s strongest hotel brand

- Market leading customer metrics

- First choice for more travellers

Scale advantage

- Largest UK network

- Economies of scale

- Superior network access

Direct digital distribution

- Market leading direct digital distribution model

- Low-cost customer acquisition & retention

Operational control

- All hotels operated by us

- High quality experience

- Consistent execution, no brand fees

- Tailored F&B offering

Property flexibility

- Low-cost access to capital

- Access to preferred sites at local level

- Lower rent costs

Everyday efficiency

- Efficient operating structures

- Standardised model & rooms

- Ongoing opportunity to drive efficiency further

Direct digital distribution

Cost efficient and provides ownership of the customer relationship

- We have market leading direct digital distribution in the UK with just 1% of sales going through OTAs

- Direct distribution has significantly lower customer acquisition and retention costs as we are not subject to high charges from online travel agents

- This approach enables us to own the relationship with the customer and invest in more effective direct and digital marketing

Lean and agile cost model

Right-sized cost base enables superior value for money offering

- We have a strong track record of material cost savings helped by our unique operating model where we retain control over all of our operations

- Our efficiency programme ensures we retain a lean and agile cost base, enabling us to deliver both quality and value for money for our guests and return on capital for our shareholders

Financial flexibility

Strong balance sheet provides offensive and defensive flexibility

We have a strong balance sheet with low leverage and access to significant levels of liquidity, allowing us to continue to invest when others may be constrained

| £’m | H1 FY26 |

|---|---|

| Cash & cash equivalents | £831m |

| Undrawn RCF | £775m |

| Total liquidity | £1.6bn |

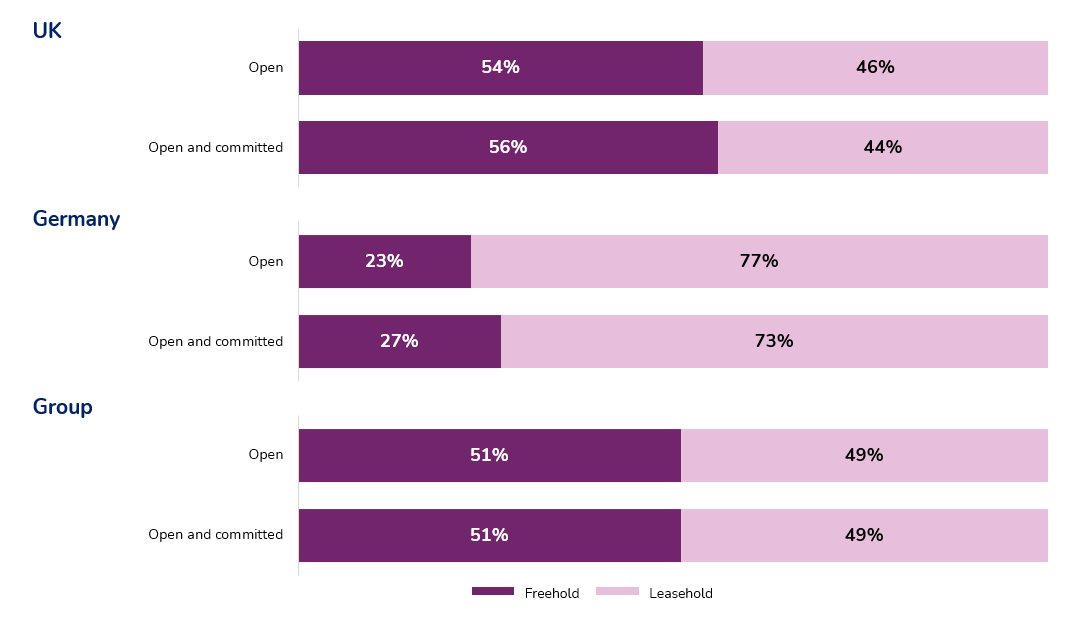

Freehold: Leasehold split

| Open estate | Total estate (open and commited) | |

|---|---|---|

| UK only | 54% : 46% | 56% : 44% |

| Germany only | 23% : 77% | 27% : 73% |

| Whitbread | 51% : 49% | 51% : 49% |

(as at H1 FY26)

The strength of our balance sheet is underpinned by our freehold estate and provides us with flexibility to optimise our estate

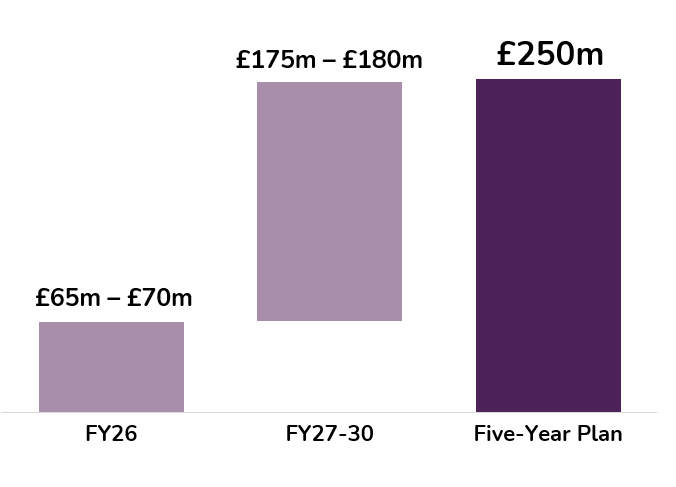

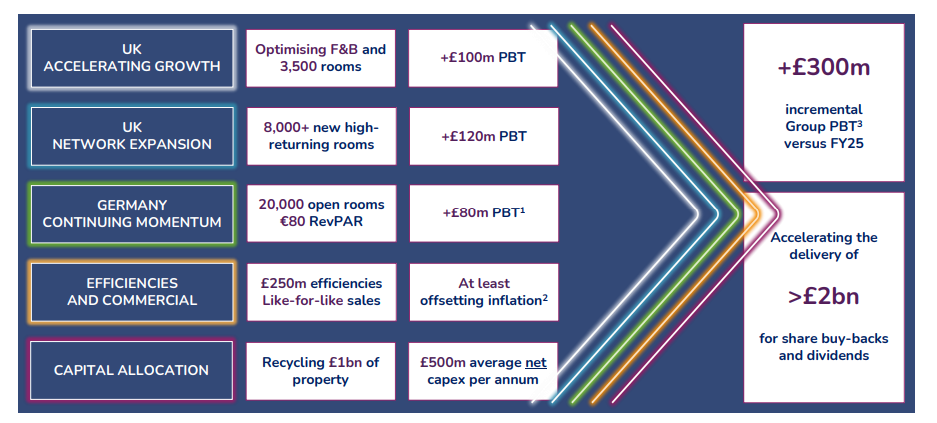

Five-year plan

By FY30 we expect to increase adjusted profit before tax† versus FY25 by at least £300m and generate more than £2bn for dividends, share buy-backs and, if suitable opportunities arise, additional high-returning investments.

† Alternative Performance Measure

1: £70m of PBT in FY30, using GBP : EUR exchange rate of 1.18

2: Annual average cost efficiencies of £50m per annum equates to c.3% of UK

cost inflation (£1.7bn cost base) and every 1% of UK LFL sales growth would

offset an additional 1% of UK cost inflation

3: Our plan assumes UK cost inflation equals our cost efficiencies and UK LFL

sales growth