Whitbread delivers another year of strong sales and profit growth

WHITBREAD DELIVERS ANOTHER YEAR OF STRONG SALES AND PROFIT GROWTH

Whitbread Plc results for the 52-week financial year to 2 March 2017

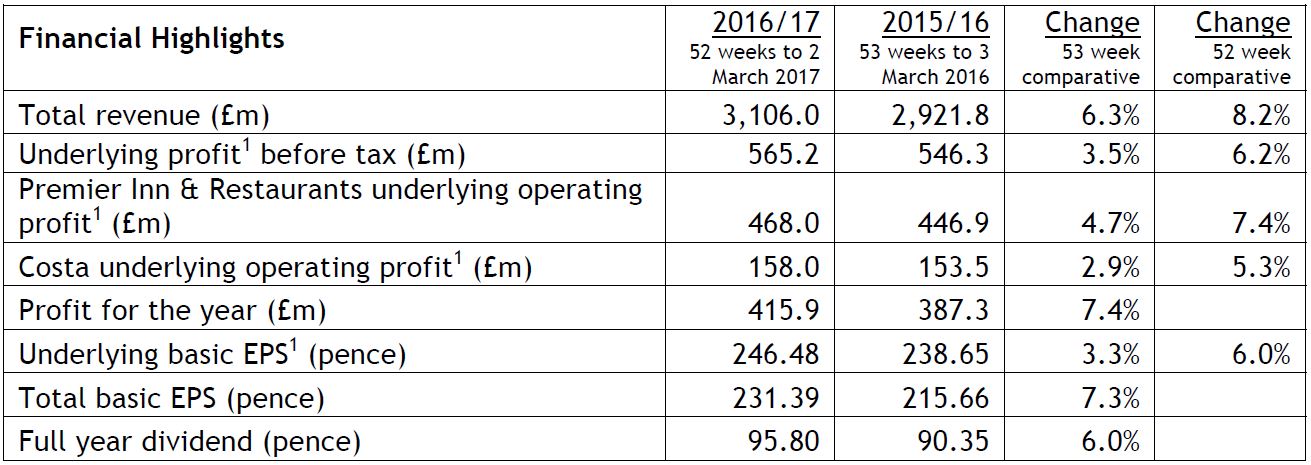

2016/17 was a 52-week year whereas 2015/16 was a 53-week year. In order to provide a clearer comparison, year-on-year growth relating to revenue, underlying profit and underlying earnings per share are shown on a 52-week comparative and a number of alternative performance measures are included in addition to the various statutory measures. For details see the notes section at the end of the document.

Financial Results

- Group total sales growth of 8.2% and underlying profit before tax up 6.2% to £565.2 million

- Premier Inn total sales growth of 9.0%, and like for like sales2 up 2.3%

- Costa total sales growth of 10.7%, system sales up 12.7% and UK equity like for like sales2 up 2.0%

- Group return on capital3 of 15.2% (2015/16: 15.3%)

- Cash generated from operations of £860.1 million, which funded cash capital investment of £609.8 million and a proposed full year dividend up 6.0% to 95.80 pence

Alison Brittain, Chief Executive, said:

“Whitbread has had another year of strong growth and continued investment with total Group sales increasing 8.2% to £3.1 billion and underlying basic earnings per share increasing by 6.0%, demonstrating the strength of our core brands. Total basic earnings per share increased by 7.3%.

In 2016/17 we made good progress in delivering on our three strategic priorities: to grow and innovate in our core UK businesses; to focus on our strengths to grow internationally; and to build the capability and infrastructure to support long-term growth.

Premier Inn’s strong sales growth benefitted from the 3,816 gross new UK rooms we opened this year and the accelerated maturity of the c.9,000 rooms we have opened over the last two years. We delivered high customer satisfaction by leading the market on quality and value, achieved occupancy of over 80% with record levels of direct bookings at 94%, all of which supported our strong return on capital.

Costa opened 255 net new stores worldwide and we continue to roll out our successful and fast growing Costa travel formats. Costa Express had a great year installing over 1,500 machines of which 248 were in international markets. We are innovating to drive our sales growth and are pleased with the investment we are making to introduce ‘finer’ coffee concepts, leveraging our new state of the art Roastery and delivering fresher food that our customers will enjoy later this year.

Internationally, in Germany we grew our hotel pipeline to five hotels and our Frankfurt hotel received great guest feedback. We continue to have success with our profitable joint venture in the Middle East while our phased withdrawal from South East Asia is on plan. China remains an exciting platform of growth for Costa and we have a clear plan to enhance our business. We have launched five new concept stores, the results of which give us further confidence that we can capitalise on this market opportunity and grow to significant scale.

During the year we continued to strengthen our capabilities to support our long-term, growth, including developing the senior team with a number of new hires and promotions. In November we announced a £150 million cost efficiency programme to help offset investment and sector cost pressures. We have made good progress this year in areas such as procurement, supplier consolidation and labour scheduling, which has helped maintain margins.

In the year ahead we will continue to focus on organic growth and investing in our customer proposition. This, together with our efficiency programme and disciplined capital management gives us confidence in delivering another year of good progress, in line with overall expectations. Whilst we are only seven weeks into our new financial year Premier Inn has had a good start to the year and Costa has also seen positive like for like sales growth, although we remain cautious and expect a tougher consumer environment than last year.

In the longer term we remain confident that, with our significant structural growth opportunities, the power of our brands and the investments we are making, we will continue to deliver strong returns and sustainable long-term growth for our shareholders”.

Richard Baker, Chairman, said:

“Whitbread is one of Britain’s longest established and most successful companies and celebrates 275 years in business this year. We are very aware of our responsibilities to ensure that this great British company continues to thrive and, as such, we are focused on driving growth while managing risk and demonstrating excellent corporate governance. We operate a conservative approach to the management of our balance sheet and this provides us with a solid base in turbulent and changing times. Our strong cash flow generation has enabled us to increase the full year dividend by 6.0% to 95.80 pence”.

For further information contact

Whitbread

Nicholas Cadbury, Group Finance Director +44 (0) 20 7806 5491

Anna Glover, Director of Communications +44 (0) 1582 844 244

Joanne Russell, Director of Investor Relations +44 (0) 1582 888 633

Tulchan

David Allchurch + 44 (0) 20 7353 4200

For photographs and videos, please visit the corporate media library: www.whitbreadimages.co.uk

There will be a presentation for analysts at 9.30am in the Auditorium at Deutsche Bank, Winchester House, 1 Great Winchester Street, EC2N 2DB London. There will also be a live webcast of the presentation at 9.30am which will be available on the investors’ section of the website.